The vicious circle of pharmaceutical tendering

- October 22, 2018

Pharmaceutical tendering and contracting has long been common in healthcare for medical devices and diagnostics; the Gulf Cooperation Council and the Jamaica Commodity Trading Company have been using pharmaceutical tendering since the 1970s. In the 1990s, international institutions such as the World Health Organisation and the World Bank endorsed tendering as the preferred procurement process for drugs.

Pharmaceutical tendering and contracting is now approximately a quarter of total global turnover, though this is just an estimate as the level of tendering is market- and product-dependent. The impact of tendering on pharmaceutical business, however, is mainly through price erosion.

Open tendering, which means all suppliers are invited to bid, results in the lowest prices, especially when many suppliers are interested in the contract. Other drivers of price erosion include high prices, high volumes, and tendering by ‘winner takes all’ where there are alternatives available.

The ‘winner takes all’ pricing game

We developed a pricing game where the participants are split into competitive teams that are bidding for the business of six hospitals. Each hospital is tendering for full volume in a ‘winner takes all’ market. The hospitals have different volume needs, incumbent player(s) at the start of the game and price sensitivity, and participants know or can imply these characteristics from the hospital descriptions. The game has pre-set award conditions, threshold to switch (if any), growth rates by customer, and ‘attractiveness’ to the customers.

As the game continues, teams take on new roles, for example with a new entry of a branded or generic competitor, where more and more competitors are pitching to the same set of customers. There are three to six rounds of bidding, and after each round the teams get the results of their bids and prepare for the next round.

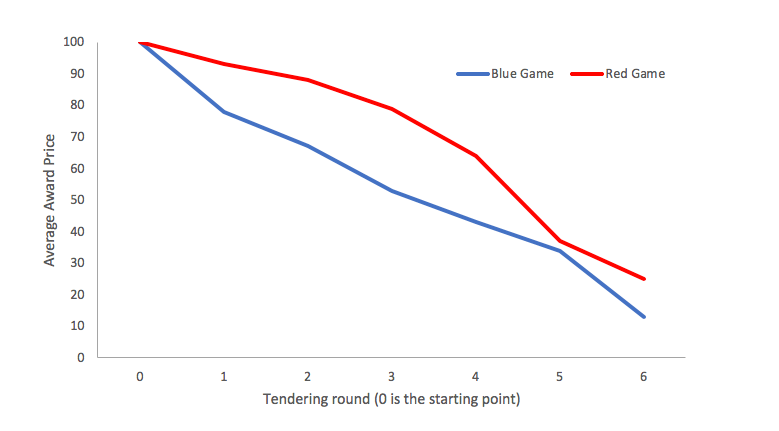

Repeating the pricing game with different players can lead to different results. Figure 1 shows two typical outcomes of the game: in the red game we see significantly slower price erosion than in the blue game. However, simulated market conditions were similar and the purchasing decision making was pre-programmed to be identical.

Figure 1: Price evolution over six rounds of tendering

This illustrates a key point of price competition: while authorities or customers set the conditions to allow price competition, it is the competitive behaviour of the teams that defines the intensity of price erosion. The speed of price erosion is function of the number of competitors, aggressivity of the players, and the lowest cost of goods in the game.

The vicious circle of pharmaceutical tendering and contracting

For the customer, tendering can be an efficient tool for lowering prices, but there are also challenges:

• Difficulties in estimating quantity of product required

• Requirement for expertise and resources; may need dedicated teams

• May be complicated by legal issues

• May lead to supply problems

From the company side, tendering may offer a chance to break through the monopoly of an incumbent competitor. It can also increase transparency and lower risk for fraud. However, efficient tendering can significantly cut profits, so much that it may reduce the number of suppliers. This in turn could raise prices and increase the risk of shortages.

The system can be made more sustainable by reducing the administrative burden through pre-qualifications and electronic bidding systems. Contracts may be split between two or more suppliers, to minimise the risk of shortages and to maintain long-term competition.

On the industry side, focus is mainly on communicating the risks of tendering:

• Quality risks when lowest price is the dominant criterion

• Medical risks when substituting one product for another

• Shortages when ‘winner takes all’ tenders are used

• Lack of optimisation of medical therapy by treating all patients alike.

In the market, companies will try to get out of the ‘winners take all’ and ‘lowest price’ paradigms by differentiating products through formulation or delivery systems.

What seems to be missing on the industry side is the understanding that price erosion in tendering markets is strongly influenced by their own behaviour. In the tendering environment, aggressive price cutting seems to be the rule rather than the exception. One of the core reasons is that almost all pharmaceutical companies use market share and sales as the most important key performance indicators of commercial and management functions.

Conclusions

Pharmaceutical tendering and contracting will stay as a key procurement approach for pharmaceutical products, especially for hospital products but also in outpatient settings for generics/biosimilars or other segments of products with low differentiation. All stakeholders are recognising the opportunities and risks of efficient tendering.

We should expect a reduction of the ‘winner takes all’ lowest price tenders, however customers will keep searching for the best balance between low price and sustainable high-quality supply.

To find out how Valid Insight can support you in pricing & negotiation, contact us at discover@validinsight.com or meet our team at ISPOR Europe 2018 | 10-14 November 2018 | Barcelona (stand 518)

- 0

- 0

- 0

Article Useful.

Thank for sharing